Nothing impacts the housing market like an election and rising interest rates. Now that Labor has been sworn in, what does this mean for the Sydney property market?

Following the 0.25% interest rate rise and, in the lead up to the election, we have noticed an increasing trend of buyers “sitting on their hands”. The perceived fear of missing out (FOMO) has well and truly left the market. This hesitation from buyers and sellers has resulted in a lower level of advertised listings across the board. Prices are projected to remain stable for the remainder of the year as buyers continue to wait for a shift in the market (prices are down 0.3% in Syd). Motivated vendors are selling in a market with savvy buyers looking for any opportunity to take advantage of the negative market sentiment.

For opportunistic buyers looking to take advantage of a plateauing market, many will not see price adjustments in Sydney’s blue chip regions (Eastern Suburbs, Lower and Upper North Shore and the Inner City of Sydney).

These areas continue to see high levels of demand and lowering levels of supply, causing prices to remain strong. 1 Darling Street Glebe, sold for $1,900,000 on May 10th after agent, Matthew Carvalho from Ray White Surry Hills took the property to market with a guide of $1,500,000 weeks earlier. The property saw 20 contract holders and 118 group inspections, only to sell days prior to auction.

“Darling Street was our busiest campaign over the past 6 weeks. The $1,000,000 to $2,000,000 bracket remains the strongest. The majority of buyers inspecting were young couples upgrading out of smaller apartments.” said Matthew Carvalho.

The top end of town still remains strong with record sales continuing in the Eastern Suburbs. Alex Phillips from PPDRE, recently sold 72 Brigton Boulevard, North Bondi for $10,250,000. The property was originally guiding $7,500,0000 before adjustments were made throughout the campaign.

New policies looking to be implemented by the Labor government will assist buyers entering the market. However, we are unlikely to see the benefits until these policies come into effect, which could take months or even years.

“The Labor government’s policy will obviously help some first home buyers get into the market, but it’s relatively limited … These policies that lift demand do tend to lift house prices, but that impact is likely to be relatively small,” – ANZ Senior Economist, Felicity Emmett.

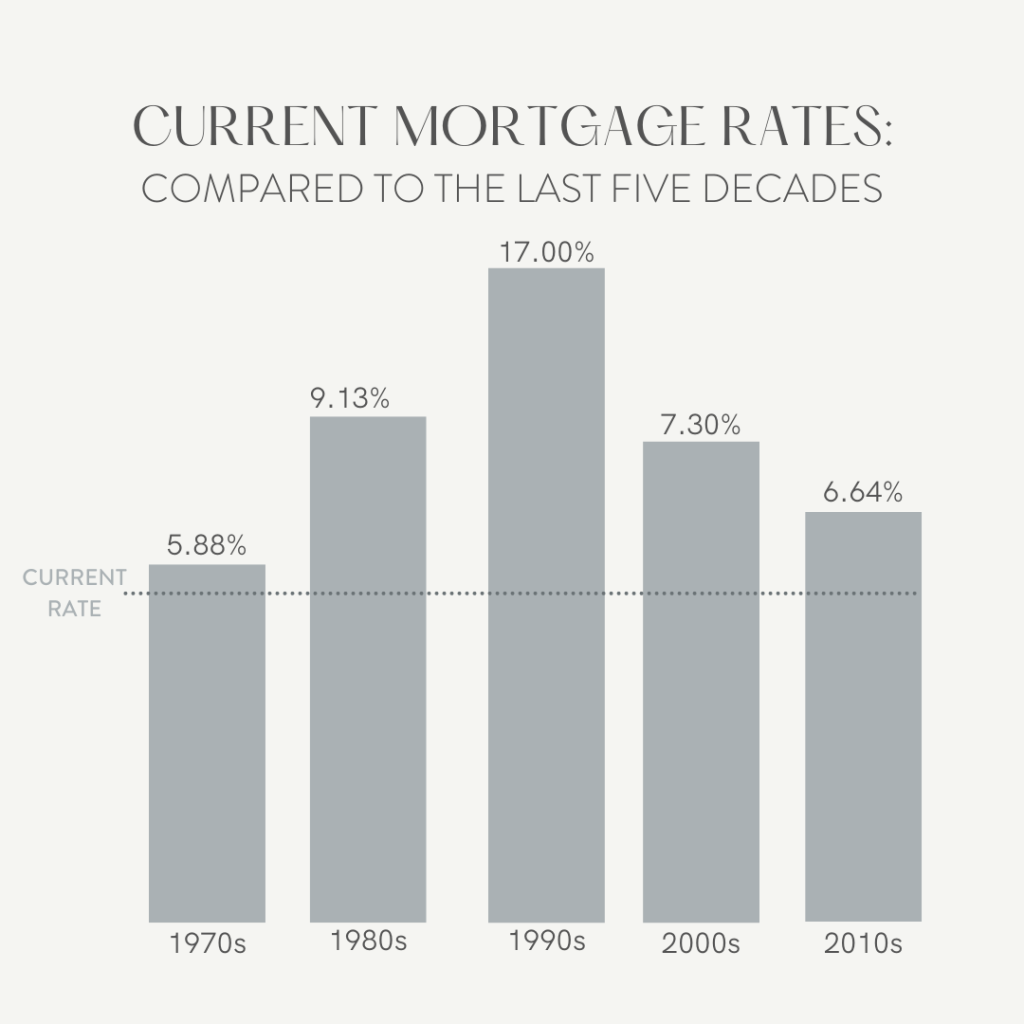

Now that the election has passed and buyers and vendors come to realise the market is indifferent, the only thing that will slow the market is continuing interest rate rises, with projections being that interest rates will reach 2.6%. Even then, interest rates will still be at historically low levels.

As hesitant buyers wait to see how the market reacts to these changes, there will be excellent buying opportunities unlocked. Those buyers that are continuing their search while the rest of the market waits for a change in prices will see the greatest deals. Vendor motivation is high and buyer competition is lowering.

Get in touch today to see how we can assist.

Thomas Alpe | General Manager at Cohen Handler Buyers Agency

0414 011 222 | [email protected]