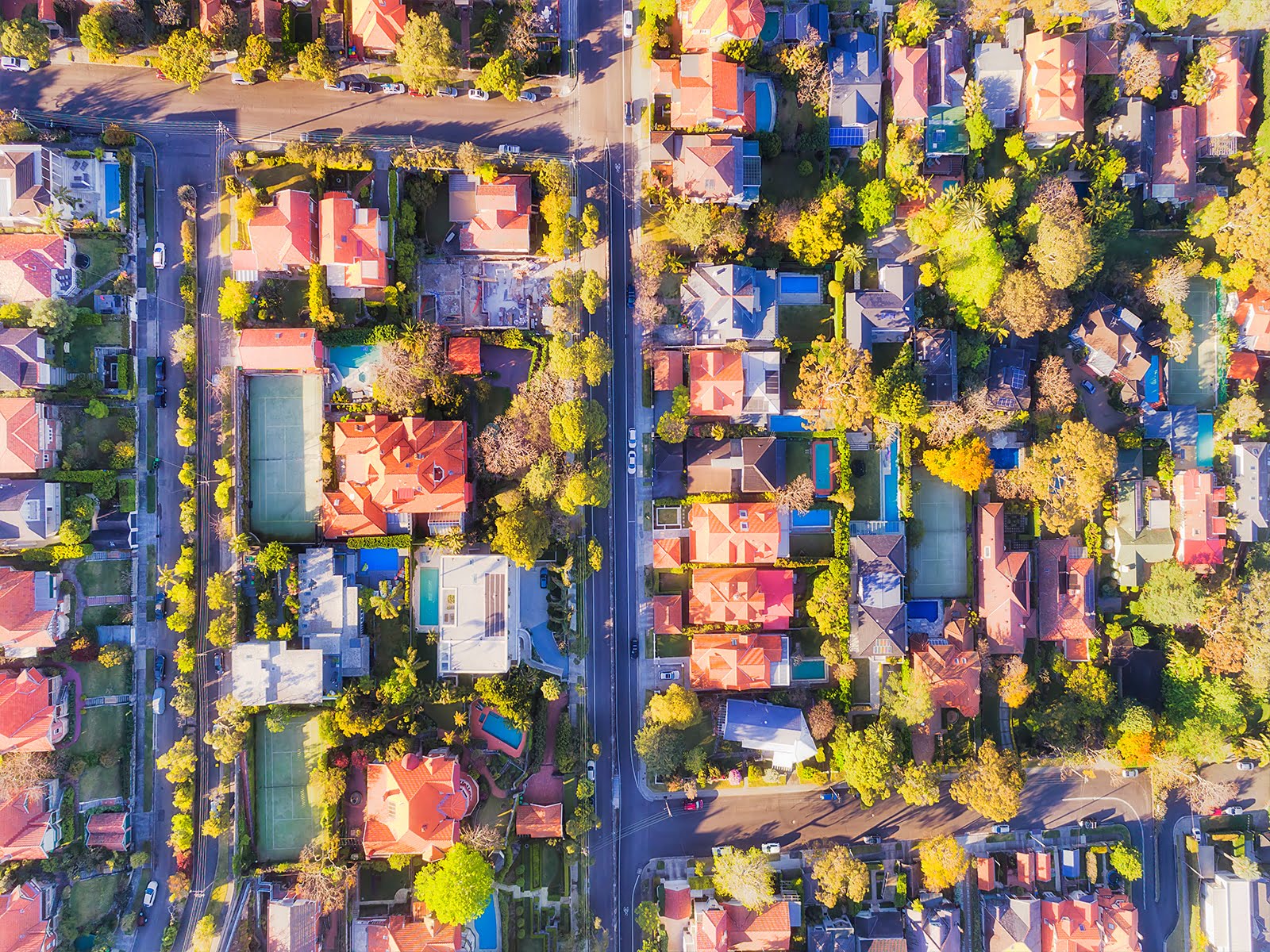

As August drew to a close, key metropolitan property markets showed signs of solid recovery after almost two years of an overall slowdown.

According to CoreLogic’s August Hedonic Home Value Index, national dwelling values increased by 0.8 per cent, the first overall rise since October 2017 and the largest single monthly improvement since April 2017.

CoreLogic research director, Tim Lawless, said the good news was that Australia’s housing

market recovery had “gathered some pace in August”.

“While the ‘recovery trend’ is still early, it does appear that growth trends are gathering some pace, particularly in the largest capital cities,” he said.

He put the healthy move forward down to an increase in auction clearance rates and more active buyers at a time when stock is still low.

Mr Lawless also noted that the improvement in values across most capital cities was fuelled by buyer confidence post the Federal election, coupled with historically low interest rates and a continued easing of credit policy.

“The recent growth is a continuation of a trend seen throughout the year, whereby value falls were consistently losing momentum and have now started to rise,” he said.

Sydney and Melbourne have been leading the charge in this latest recovery. The CoreLogic data showed that our two largest cities had both experienced their third consecutive month of gains while Brisbane has now seen two months of positive movement.

Financial issues

The significant rise in values aligns with the increase in auction clearance rates and more buyers entering the market, as stock levels remain low.

“It’s likely that buyer demand and confidence is responding to the positive effect of a stable federal government, as well as lower interest rates, tax cuts and a subtle easing in credit policy,” Mr Lawless said.

Borrowing capacities have increased recently. As such it looks to be a good time for buyers looking to upgrade.

“Although values have fallen across the board over recent years, the larger declines amongst more expensive properties mean that they are relatively more affordable for those looking to upgrade,” Mr Lawless said.

The RBA kept the cash rate on hold on Tuesday September 3 at a record low of one per cent. It is expected the next move in interest rates will be up, but that might not be for some time.

Investment trends

Locations close to Sydney and Melbourne city centres recorded the biggest value increases over the last quarter.

“The rapid recovery across higher valued properties makes sense considering this sector of the market recorded a more substantial correction,” Mr Lawless said.

Sydney has endured a 6.9 per cent fall in dwelling values over the last 12 months, they have fallen 1.3 per cent since the September 2017 peak but over the last five years they have risen 19.2 per cent.

In Melbourne values fell 6.2 per cent over the past year, they have fallen 9.5 per cent since the peak but have risen 24.8 per cent in the last five years.

In Brisbane values have dropped 2.1 per cent over the past year, have fallen 2.5 per cent since the peak but have increased 7.2 per cent over the past five years.

National rental markets recorded a further fall of 0.1 per cent over August, the third consecutive month of falls.

Value growth is now outpacing rental growth and that is impacting upon rental yields. Most capital city regions are recording yields higher than a year ago but this new data shows that yields are now stabilising or falling.

As Sydney and Melbourne lead the increase in dwelling values, they are also leading the softening of rental yields.

“With mortgage rates low as well as low yields across most asset classes, lower rental yields aren’t likely to be much of a disincentive to investors,” Mr Lawless said.

Auction clearance – highs and lows

Auction clearance rates continue to improve. They are now at their highest levels in Melbourne and Sydney since early 2017.

In Sydney, dwelling values recorded a 1.6 per cent rise over August with the median dwelling value now sitting at $790,000 according to the report.

By the final week in August, Sydney had 584 homes go under the hammer with a preliminary auction clearance rate of 78.9 per cent. This was an increase on the week prior when 503 auctions returned a final clearance rate of 78.1 per cent. Flashback to the last week in August, 2018 and the clearance rate for the Harbour City was just 53.8 per cent on 664 homes auctioned.

During August, Melbourne’s median dwelling value improved by 1.4 per cent to $626,703.

In the last week of August, Melbourne’s preliminary auction clearance rate was 76.1 per cent after 769 homes went to auction. Just one week earlier, the 662 auctions turned over a slightly higher 77 per cent rate. The Victorian capital showed a marked improvement in August this year compared to the same time in 2018 when 805 homes were auctioned with a 57 per cent clearance rate.

Head north, and Brisbane had a slight improvement in the median dwelling value during the month, moving up 0.2 per cent to $485,493. Although the Queensland capital’s auction market is not as widespread as the other two capitals, the local clearance rate in Brisbane still gives buyers and vendors alike an indication of how the market is travelling.

For the last week of August, Brisbane’s clearance rate sat at 45.8 per cent from 118 auctions, up on the 43.3 per cent returned for the same week last year with 112 homes.