When you are looking to buy property anywhere in Australia, you will likely need to consider the cost of stamp duty as part of your deposit and purchase costs. Some states will have exemptions and concessions for first home buyers, but not everyone is eligible. It is important to understand of how stamp duty might impact your purchasing capacity and decisions for your home or investment property.

What is Stamp Duty?

Stamp duty was first introduced in 1965 in NSW with other states following suit. It is also known as Transfer Duty and is a one-time tax collected by state governments and territories when you purchase a property.

The fee is calculated as a percentage on the property’s value. This percentage may also vary depending on the property’s value.

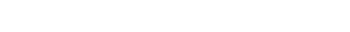

Average cost of Stamp Duty relative to income

According to PropTrack the average cost of stamp duty in Australia is now over $30,000, but it can be significantly higher.

In Sydney and Melbourne, for example, stamp duty can easily cost half a year’s worth of income for an average earner. Each state government offers stamp duty exemptions and concessions for first-home buyer with certain criteria and conditions.

.

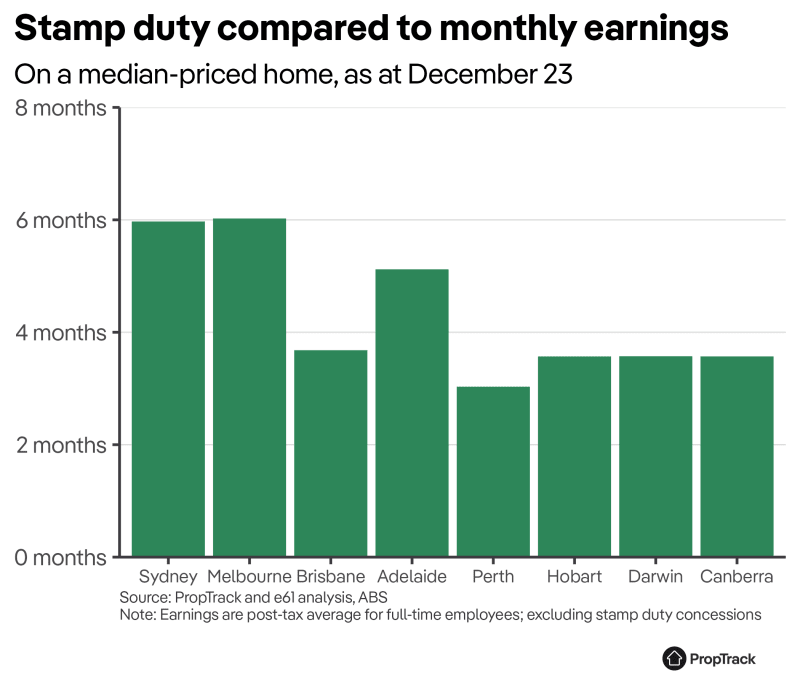

Bracket Creep Has Increased the Relative Cost of Stamp Duty

PropTrak’s Bracket Creep Graph highlights the change over time of the cost of Stamp Duty across all national sales.

Around 80% of properties now fall into the 3-4% and 4-5% range, compared to the early 2000’s with 70% of all sales falling into the 2-3% range.

Stamp Duty Costs Across the Country Based on Median Prices

These estimates are based on established properties without concessions or exemptions. Median prices are sourced from Corelogic’s Home Value Index as at February, 2024.

| City | Median House Price | Estimated Stamp Duty |

| Sydney | $1,128,000 | $45,495 |

| Melbourne | $778,000 | $31,182 |

| Brisbane | $805,000 | $22,075 |

| Adelaide | $727,000 | $18,760 |

| Perth | $687,000 | $26,647 |

| Hobart | $652,000 | $24,707 |

Exemptions and Concessions for First Home Buyers

If you’re looking to buy your first home, you may be eligible for stamp duty exemptions or concessions depending on the value of the property and type of purchase you’re looking to make.

These conditions may vary from state to state and carry certain conditions. Explore the relevant state exemptions:

NSW | QLD | SA | VIC | WA | NT | TAS

Stamp Duty Calculator

If you’re looking to buy a property soon, it worth using a calculator to determine your upfront costs.

Finder.com provides a free calculator tool that estimates each state’s stamp duty based on a few simple inputs. For more information relevant to your state, use the links below.

NSW | QLD | SA | VIC | WA | NT | TAS | ACT

Get in touch!

Cohen Handler can assist you in understanding all the upfront costs of purchasing a property regardless of which ever stage you’re in. We can then narrow down the type of property that fits your brief and unique set of circumstances with the goal of securing the right property for the right price. Get in touch with our team today.